Does Medicaid Monitor my Bank Account?

There are currently over 7 million people in New York enrolled with Medicaid for health insurance and coverage for home care services, care in nursing homes, and more. To ensure applicants or their beneficiary’s financial status matches what they’ve reported in their application, Medicaid offices verify assets and income levels using bank account balances and other resources. But how often does Medicaid get to look at your financial information, and what happens if what they find doesn’t match what was originally reported?

Does Medicaid Monitor Your Bank Account?

Yes, if you’re submitting a Medicaid application, the agency you’re sending it to can check your bank account. This makes sense given Medicaid is a need-based program with financial eligibility requirements so they need to verify your assets. Medicaid agencies can check your bank account balances at any financial institution you’ve used during the month you apply or during a 5 year look-back period. In cases involving Medicaid long-term care (nursing home Medicaid), a look-back period applies, meaning financial records from the past five years are reviewed to ensure assets weren’t transferred to qualify.

Once you’ve been approved for Medicaid coverage, you take on some of the responsibility of maintaining your eligibility and reporting anything that impacts it. Medicaid agencies make annual checks to account balances to ensure the Medicaid recipient still meets the right requirements. For instance, if you receive an inheritance or any other unexpected source of income that puts you over the Medicaid asset limit, you’re expected to report it, not wait for Medicaid to discover it during a yearly check.

What Financial Information Can Medicaid Access?

While Medicaid in New York doesn’t routinely check bank accounts after enrollment, applicants need to accurately report their financial resources, as discrepancies or changes may require further verification. Medicaid agencies can and will look at your balance from any bank account you’ve had in the last five years and they may also conduct property checks using public records.

To track of all of this information and annually update and confirm it, New York’s Medicaid program uses an Asset Verification System (AVS). The AVS is able to:

- Confirm information about the applicant or their spouse’s bank accounts held in financial institutions during the month of application and the 60-month look-back period

- View balances for accounts closed during the month of application or 5 year look-back period

- View information about other assets, like retirement accounts, life insurance policies, etc.

- Run searches on real property owned by the applicant or their spouse

- Identify potential transfers of assets that might need to be verified by the benefit recipient with some form of paper documentation

The goal of the AVS is not to fully automate the process but to help Medicaid offices identify changes that are worth investigating. It remains the job of the benefit recipient to confirm the information the AVS finds. If that can’t or isn’t done, the Medicaid agency will rely on the details discovered by the AVS.

What Happens If You Don’t Report?

Withholding information, whether intentionally or not, should be avoided at all costs. If discrepancies are found and it may cause a Medicaid recipient to lose their benefits, be prosecuted, be required to repay the bills for the services received while ineligible, and potentially be disqualified from receiving benefits in the future.

If you’re not sure when or how to report information to your Medicaid agency, the best thing you can do is ask questions. A small oversight might not cause any issues, but repeated or large-scale inaccuracies should definitely be avoided.

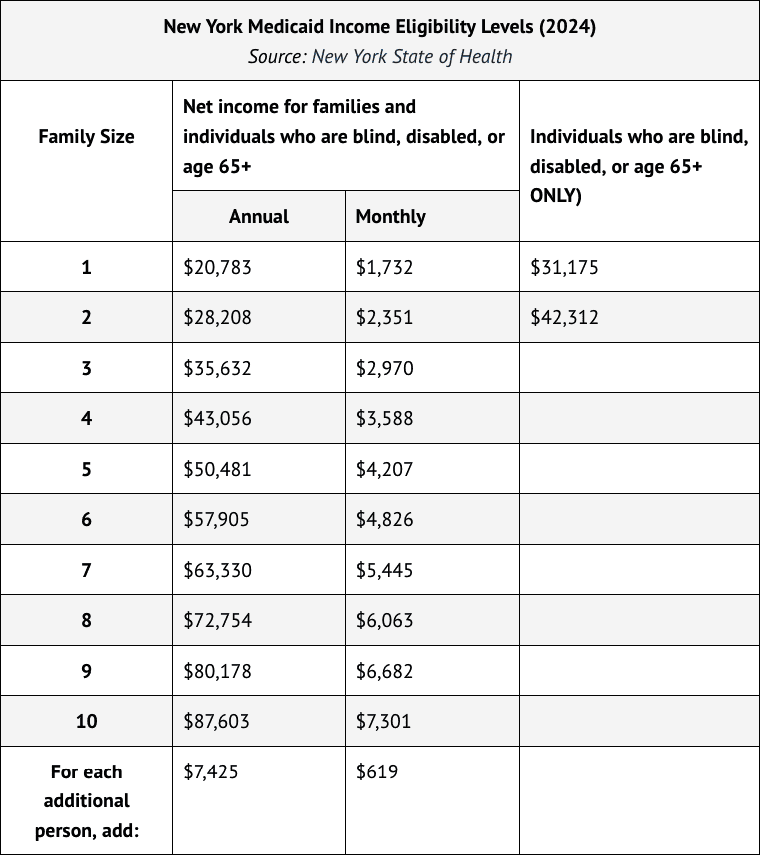

What Is The Income Eligibility for Medicaid in New York?

New York State of Health, which handles most Medicaid applications, uses Modified Adjusted Gross Income (MAGI) Rules to determine income eligibility. Individuals over 65 may still be eligible for Medicaid services even if they earn or hold more than the asset limit. Below is a chart of the income eligibility requirements for Medicaid in New York as of January 1, 2024:

Since some older adults can have more countable resources or income than this without losing their eligibility, the best way to see which health insurance options are available to you is to visit the State of Health’s Marketplace.